ChartWatchCentral Premium Stock Picks

Inflection

by

Christina Nikolov

Founder/CEO,

ChartWatchCentral, Inc.

Date: August 26, 2010

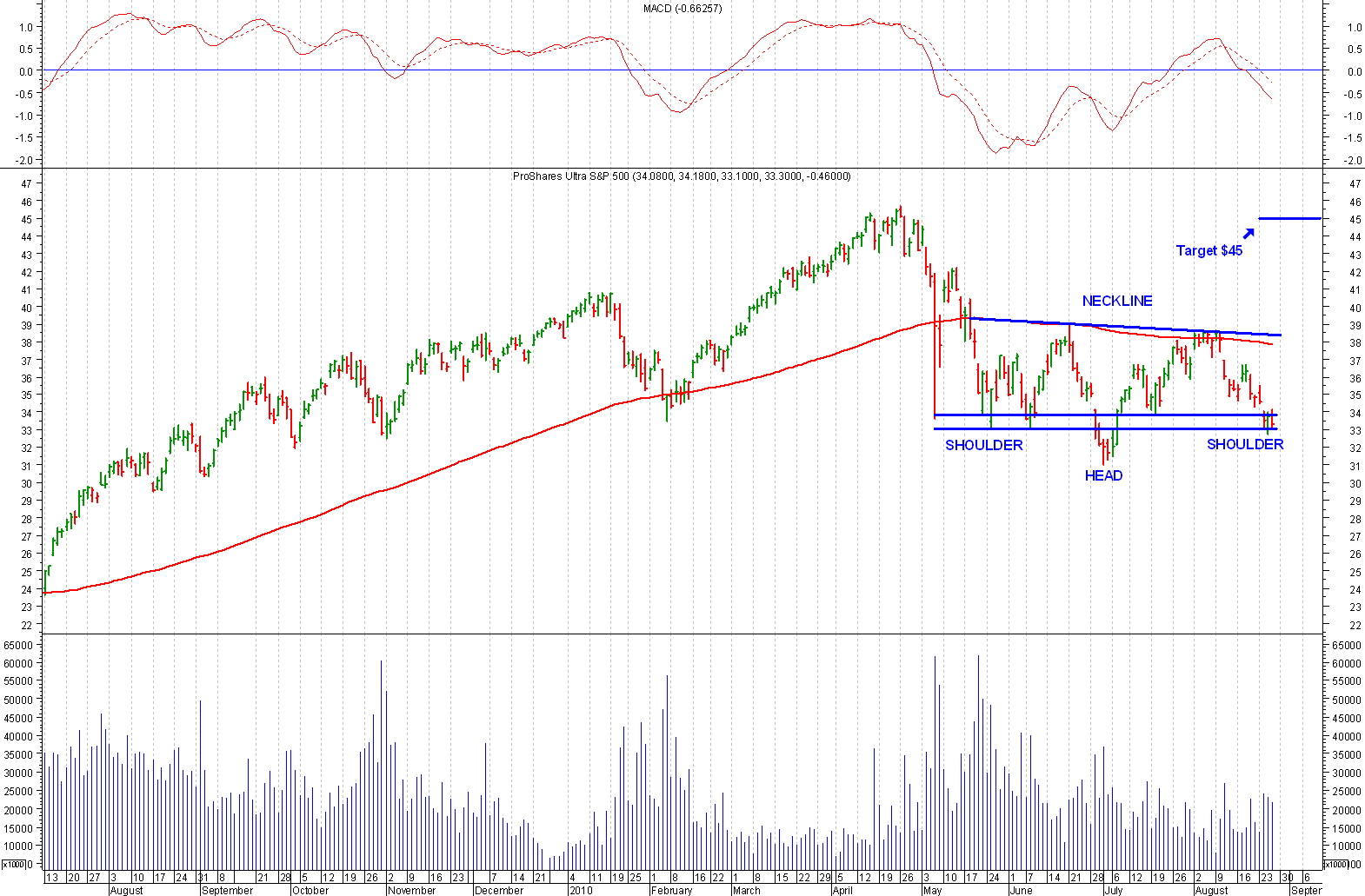

Company: ProShares Ultra S&P500

Ticker: SSO

Price: $33.30

Opinion: Bullish

Comments: We

strongly believe several stock market sectors and indices are in

the process of creating a significant bottom. Psychology plays a tremendous

role in price movement and the recent economic figures,

while likely 'one step back' within a very anemic economic recovery,

have investors falsely anticipating a double dip recession. With

fear currently spiking to historic levels throughout the investment

community, stock market

indices and sectors are presently revisiting significant support

levels.

The price deterioration in recent weeks, has been accompanied by anemic trading volume, nearly 30% below what has been typical for the month of August over the past 10 years. Since 1999, average daily volume in August has been 1.2 billion shares. In comparison, trading activity in August 2010, has averaged approximately 800 million shares. In addition, economic data in recent weeks has been nothing short of horrific, especially with regards to employment and housing.

According to data provided to CNBC by MLM Partners (illustrated below), only 20.7% of Individual Investors are currently bullish, compared to more than 30% last week. Meanwhile, 55% of all S&P500 stocks are now rated as short-term oversold. With these indicators residing at levels typically seen only at significant stock market lows, such as March 2009, November 2009 and July 2010, we strongly believe that the stock market is sitting at a major inflection point which should be taken advantage of.

There is always a point within every economic recovery, where people expect a double dip recession and we think this is where we currently reside along the economic cycle time-line. Employment always lags, housing lags, etc. Even when economic conditions are improving, there are some economic indicators which consistently procrastinate about rebounding, resulting in a doom and gloom mindset among many market pundits and stock market weakness. This inevitable disconnect produces undervalued securities and is precisely when you should be buying.

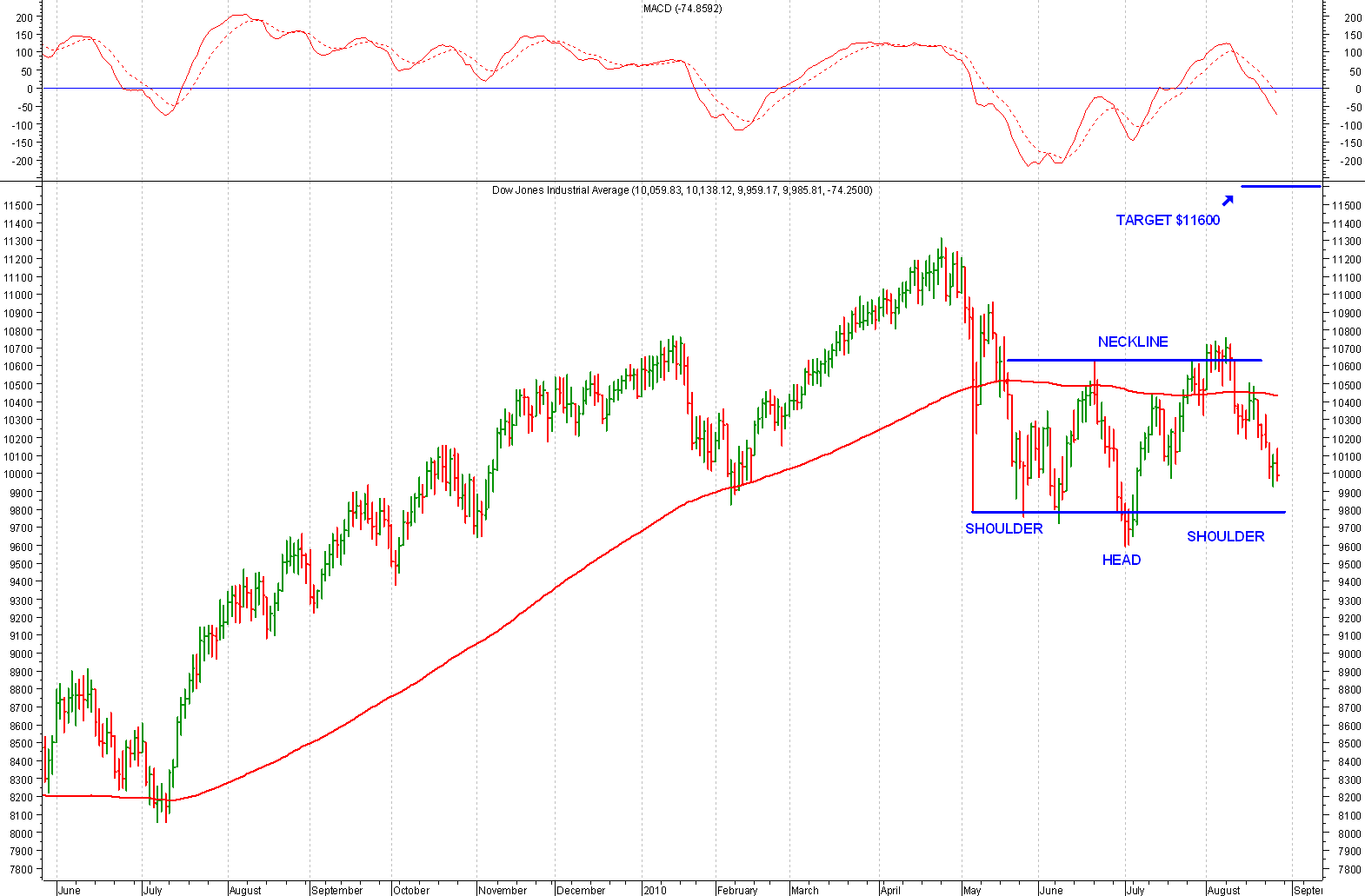

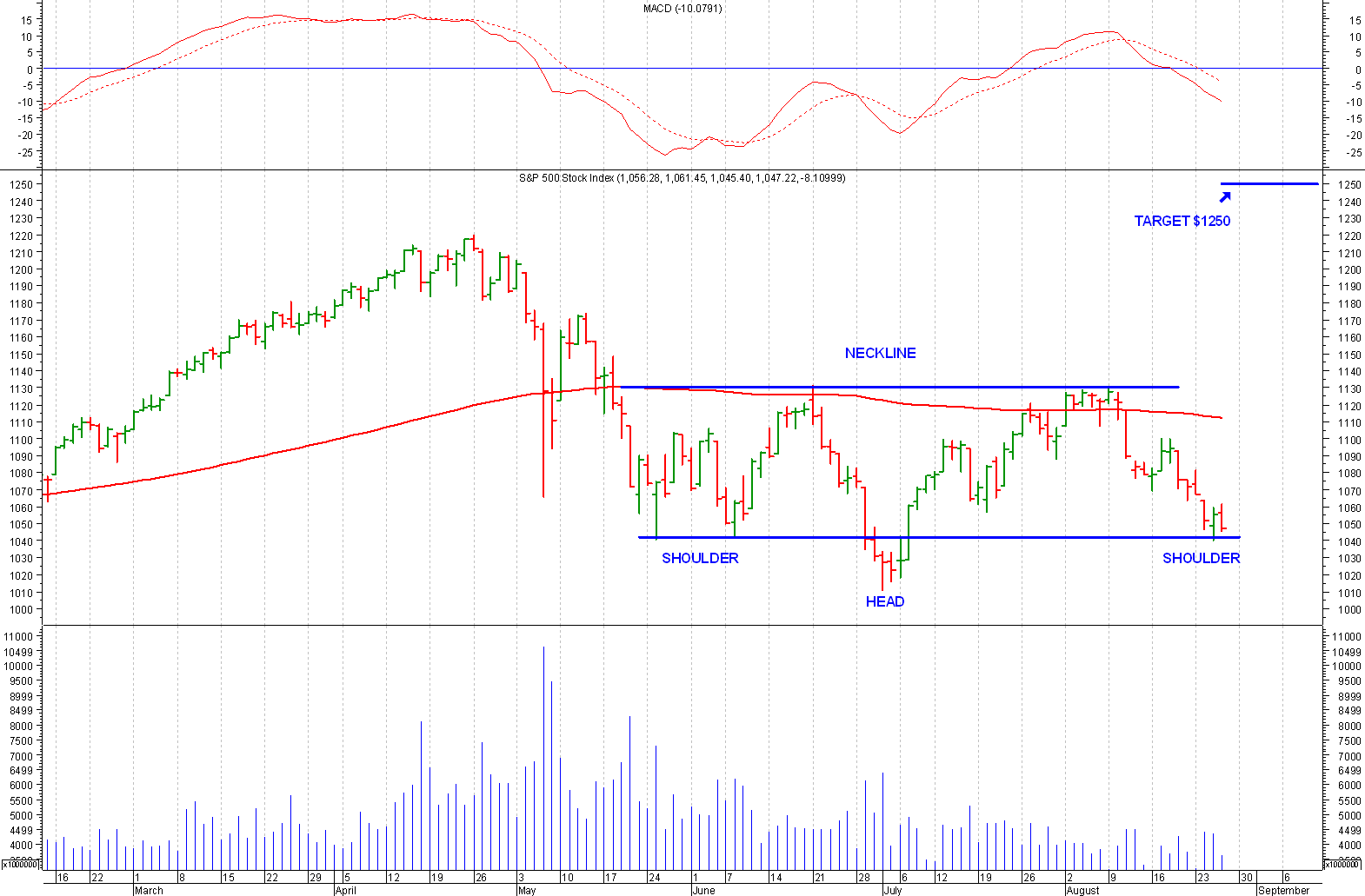

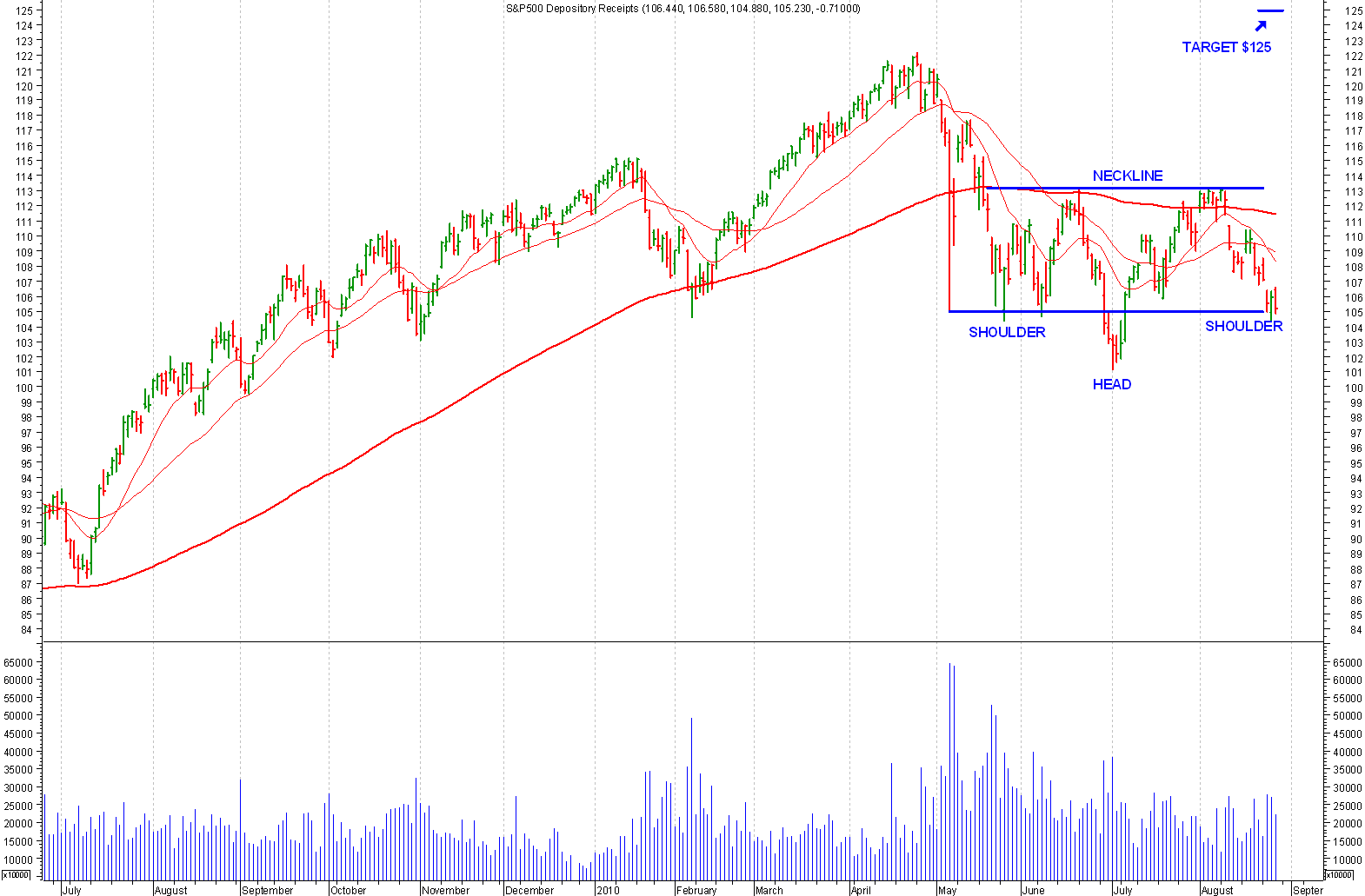

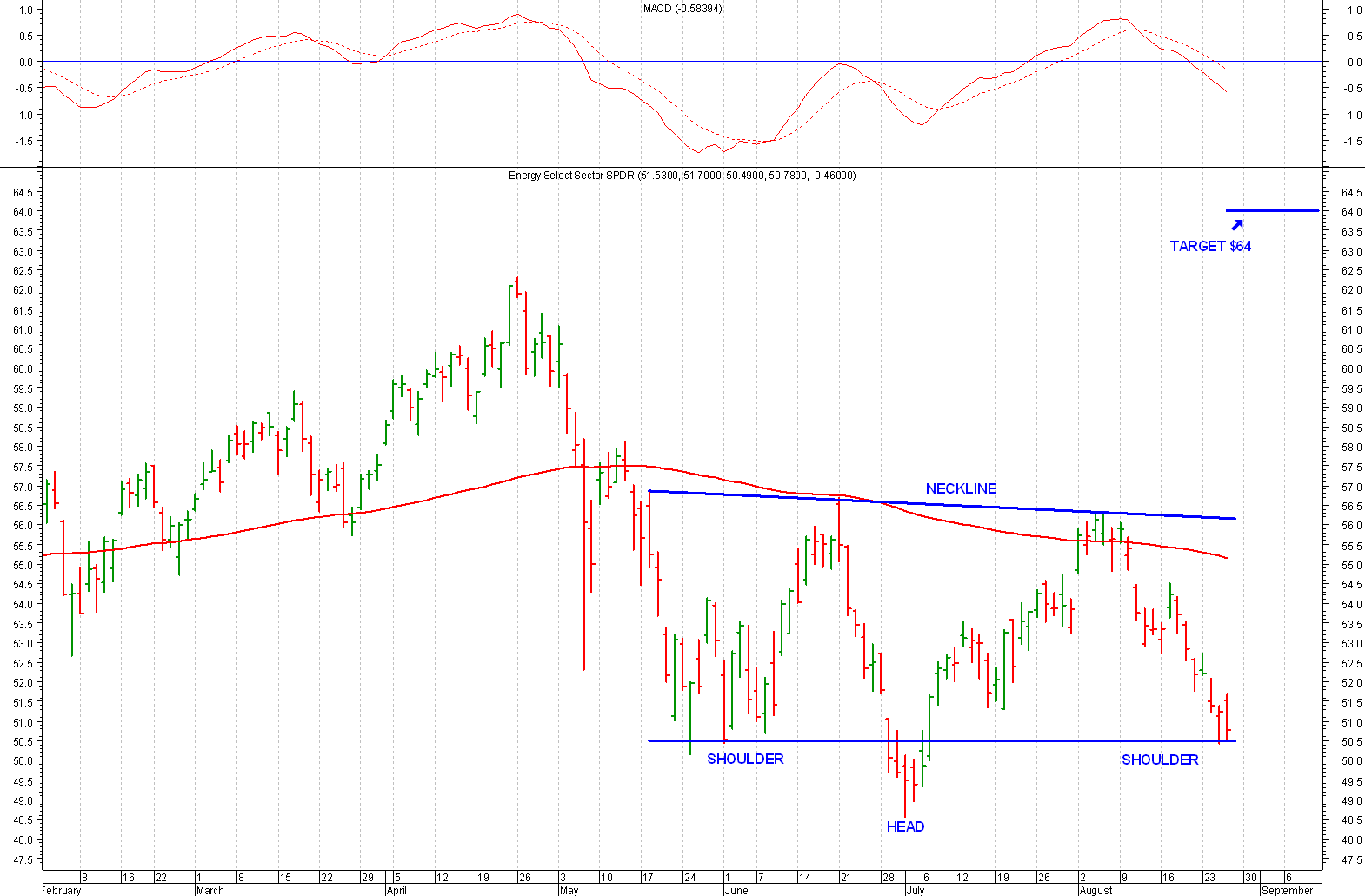

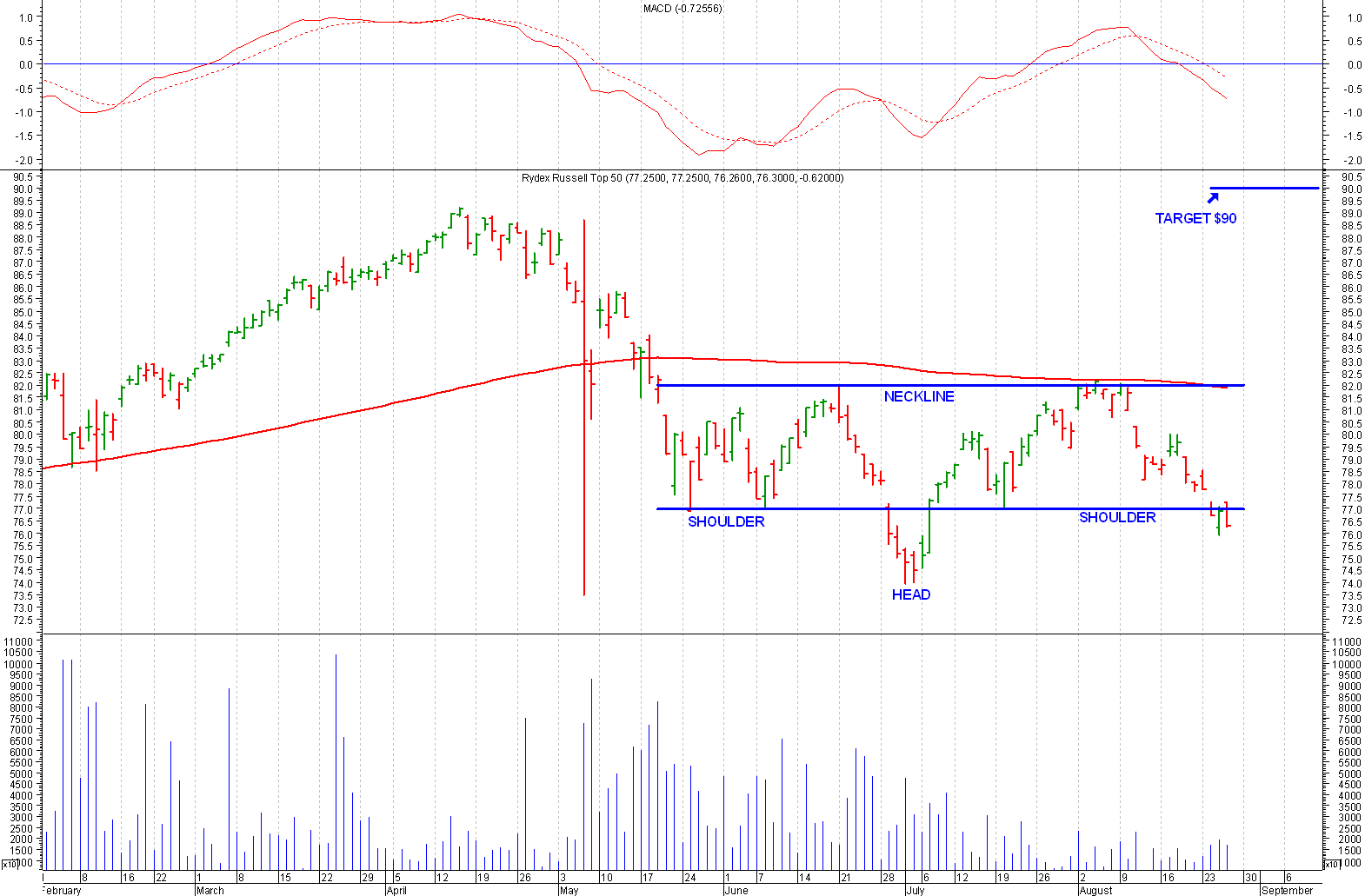

The following charts depict what appears to be 'head and shoulders bottoms' and one potential 'triple bottom.' Volume has been drying up significantly as these patterns unfold, which is tremendously bullish.

There is a high probability that this recent stock market pullback is OVER, so Buy Now and expect the market to rally over the next few months. To maximize your profits, consider buying call options which are at or slightly out of the money on any of the indexes mentioned below. We specifically recommend purchasing some ProShares Ultra S&P500 (SSO), since it seeks a return of 200% of the S&P500's daily return. Or you could further ramp up your gains with a December 33/38 Call Spread at $1.60.

|

Security Name |

Ticker |

Recent Price |

Target Price |

|

Dow Jones Industrial Average |

DJIA |

$9985.81 |

$11600.00 |

|

S&P 500 Stock Index |

SPX |

$1047.22 |

$1250.00 |

|

S&P 500 Depository Receipts |

SPY |

$105.23 |

$125.00 |

|

Energy Select Sector SPDR |

XLE |

$50.78 |

$64.00 |

|

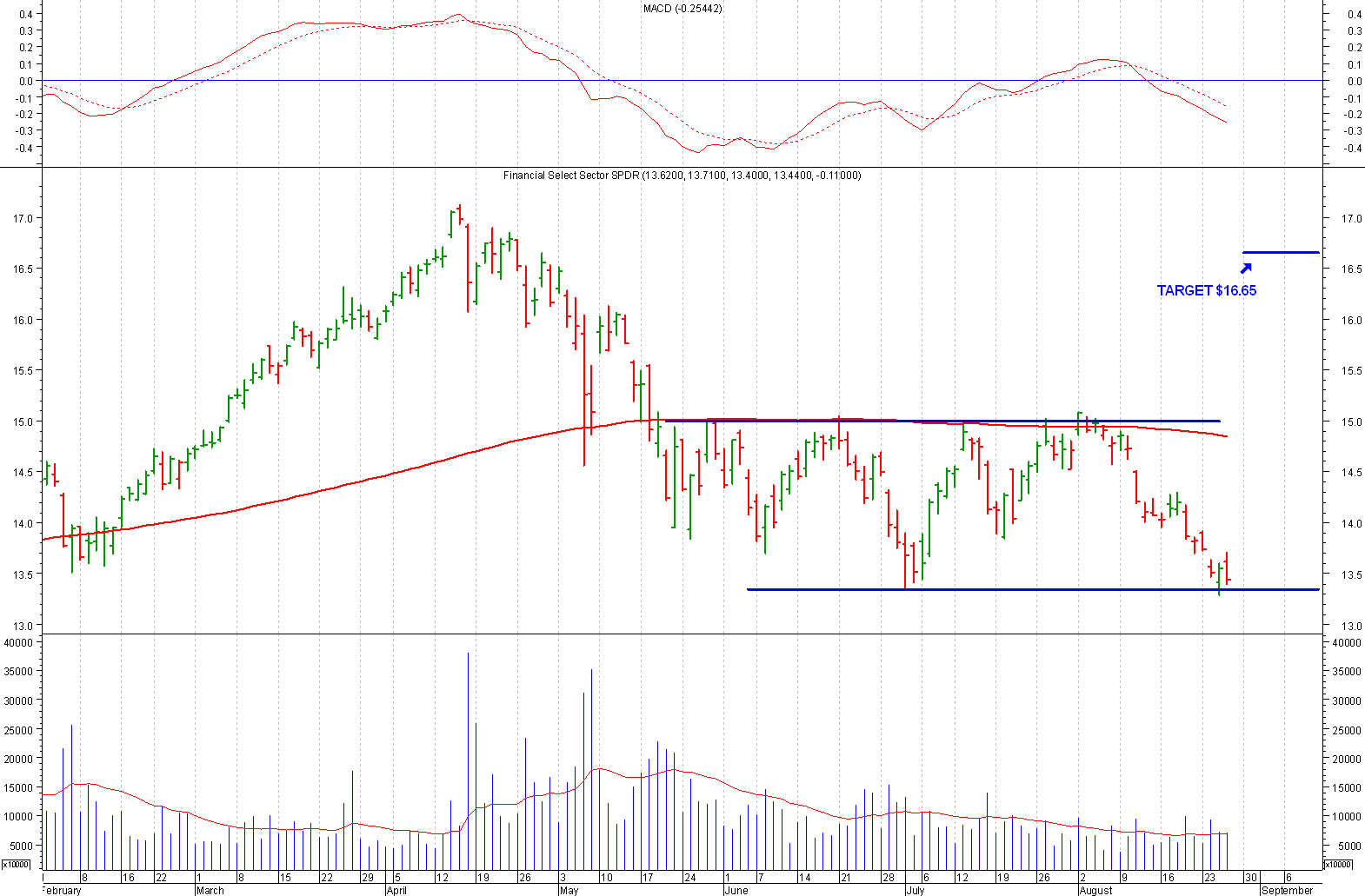

Financial Select Sector SPDR |

XLF |

$13.44 |

$16.65 |

|

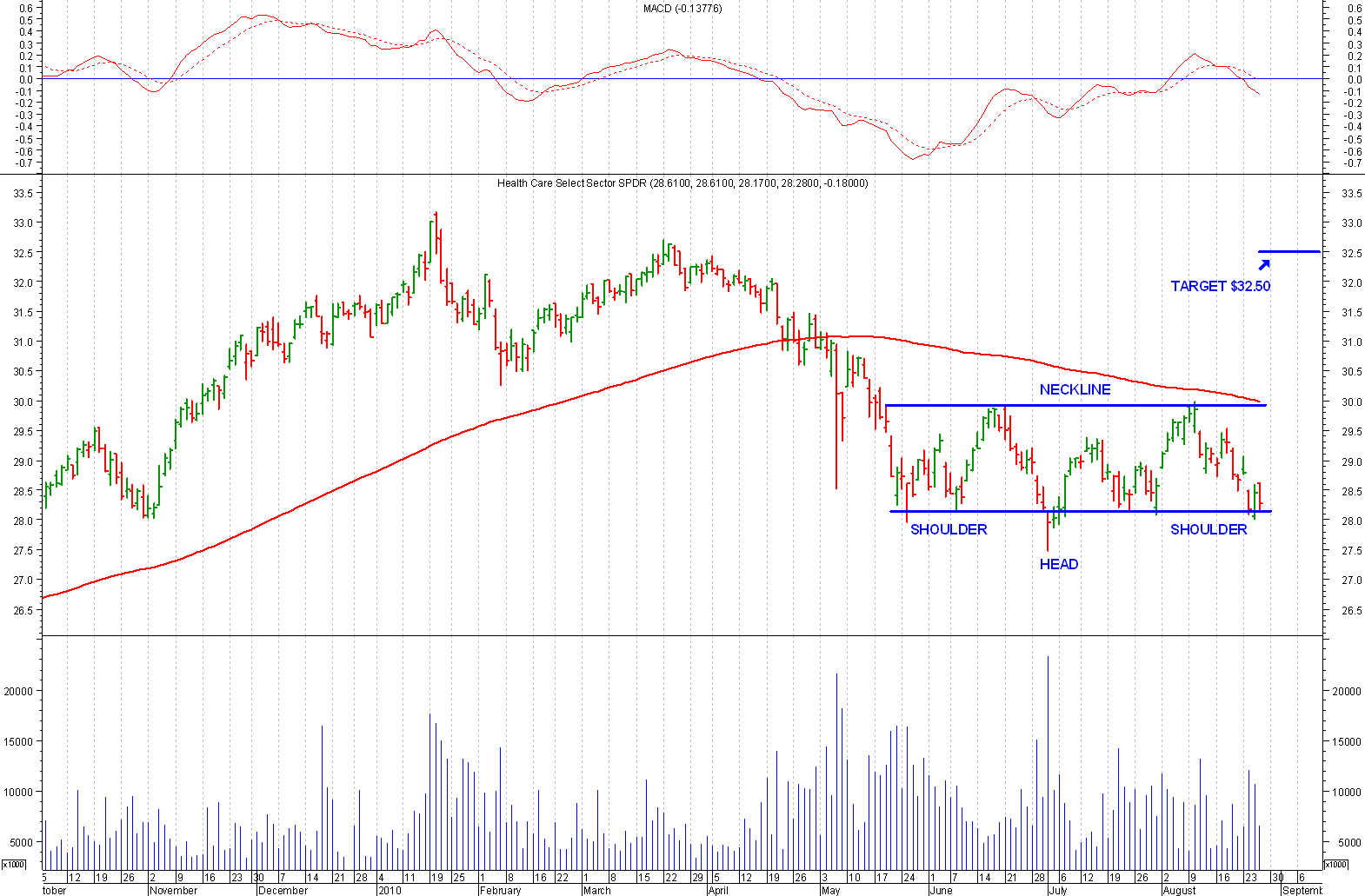

Healthcare Select Sector SPDR |

XLV |

$28.28 |

$32.50 |

|

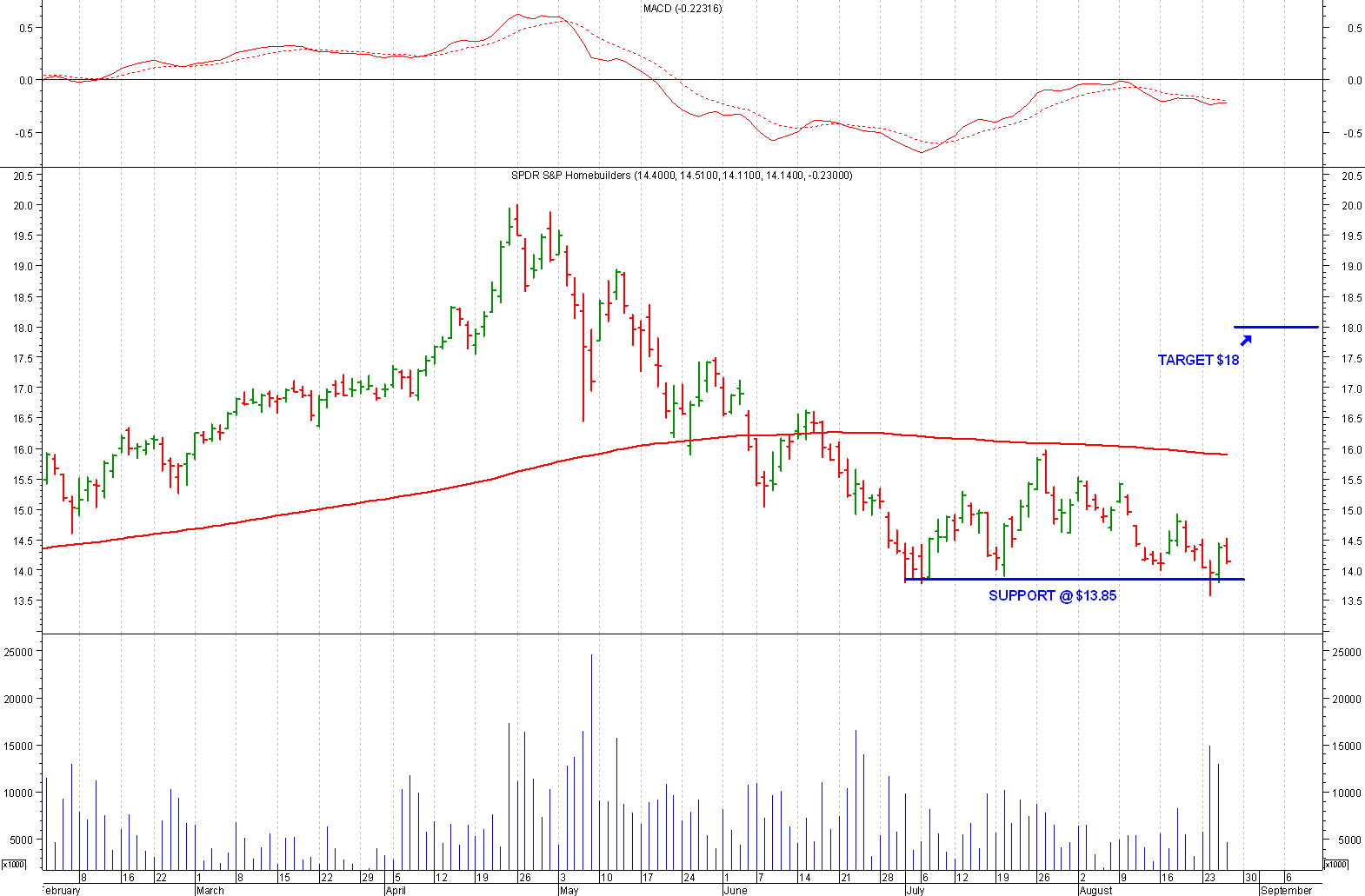

Homebuilders SPDR |

XHB |

$14.14 |

$18.00 |

|

Proshares Ultra S&P500 |

SSO |

$33.30 |

$45.00 |

|

Rydex Russell Top 50 |

XLG |

$76.30 |

$90.00 |

Dow Jones Industrial Average

S&P 500 Stock Index

S&P 500 Depository Receipts

Energy Select Sector SPDR

Financial Select Sector SPDR

Healthcare Select Sector SPDR

Homebuilders SPDR

Proshares Ultra S&P500

Rydex Russell Top 50

|

[ Home Page ] |

[ Back ] |

[ Close Window ] |