ChartWatchCentral Premium Stock Picks

Letting the Air Out

by

Christina Nikolov

Founder/CEO,

ChartWatchCentral, Inc.

Date: September 17, 2010

Company: S&P 500 Depository Receipts

Ticker: SPY

Price: $112.49

Opinion: Bearish

Comments: The

situation changes very quickly in the financial markets. After all,

it was a few short weeks ago when bullish sentiment was at

20% (near historical lows) and we posted a tremendously bullish

commentary, where we perfectly timed the most recent market bottom.

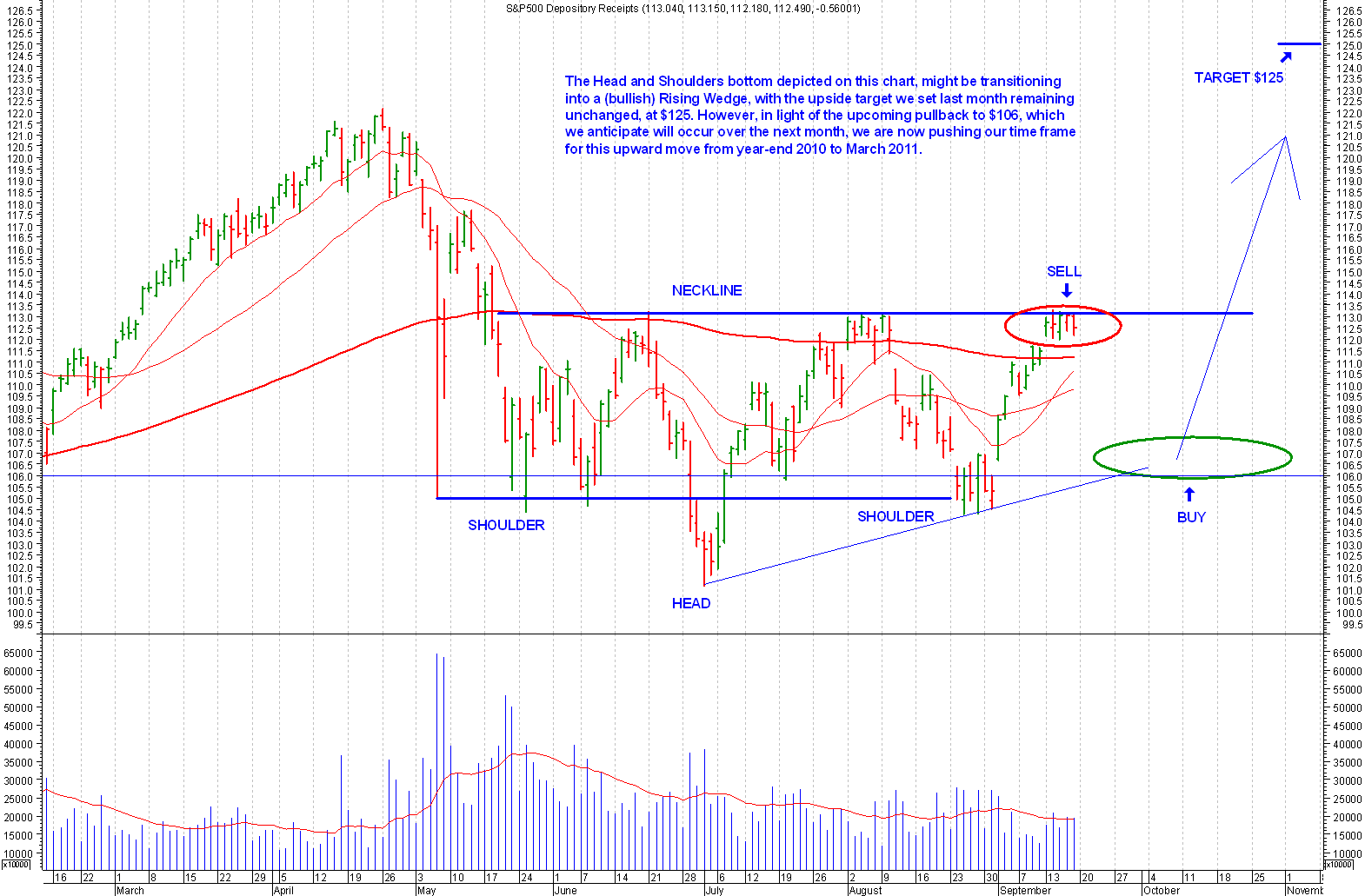

Since early May, the Standard and Poor's 500 Depository Receipts (SPY) have been trading within a tight range, between approximately $105 and $113. And now that prices are once again perched near the top of its recent confines, kinks are starting to appear in the armor. That said, we believe the market is not quite ready to move higher and some backing and filling is essential before the market can hurdle major overhead resistance at the June, August and now September peaks.

Over the next month, we anticipate that SPY will likely pullback from its current price of $112.49, to approximately $106, which coincides with an uptrend line connecting the July and August lows. This translates to approximately 1060 on the S&P 500 Stock Index and 10,100 on the Dow Jones Industrial Average.

To profit from upcoming market weakness, we suggest selling an October or November 2010 call spread and then using the credit received from that transaction to finance the purchase of a November put option or November put spread, which could reduce your entry cost to virtually nothing.

Our suggestion: Sell a November 112/114 call spread at $1.12 and use the net credit from that transaction to purchase a November 109/112 put spread at $1.00. Depending on your commission costs, this trade will cost you absolutely nothing after commission. And if the market does fall as we predict, you could easily double your money over the next month. The best part of this strategy is that, with the exception of potential margin requirements, you are not using your own money for this put option trade. Not to mention, when you buy back the call spread, you will profit as well, since the price of the call spread will narrow, due to time decay and its being further out of the money as prices decline.

This trade does not come without

risk. After all, should the market move against you, the put spread

you purchased will decline in value, while the call spread you shorted

will increase in value. So be prepared to cut your losses quickly

if SPY decisively slices above $113.

|

[ Home Page ] |

[ Back ] |

[ Close Window ] |