ChartWatchCentral Premium Stock Picks

Drilling Deeper

by

Christina Nikolov

Founder/CEO,

ChartWatchCentral, Inc.

Date: September 15, 2010

Company: Exxon Mobil Corp.

Ticker: XOM

Price: $61.00

Opinion: Bearish

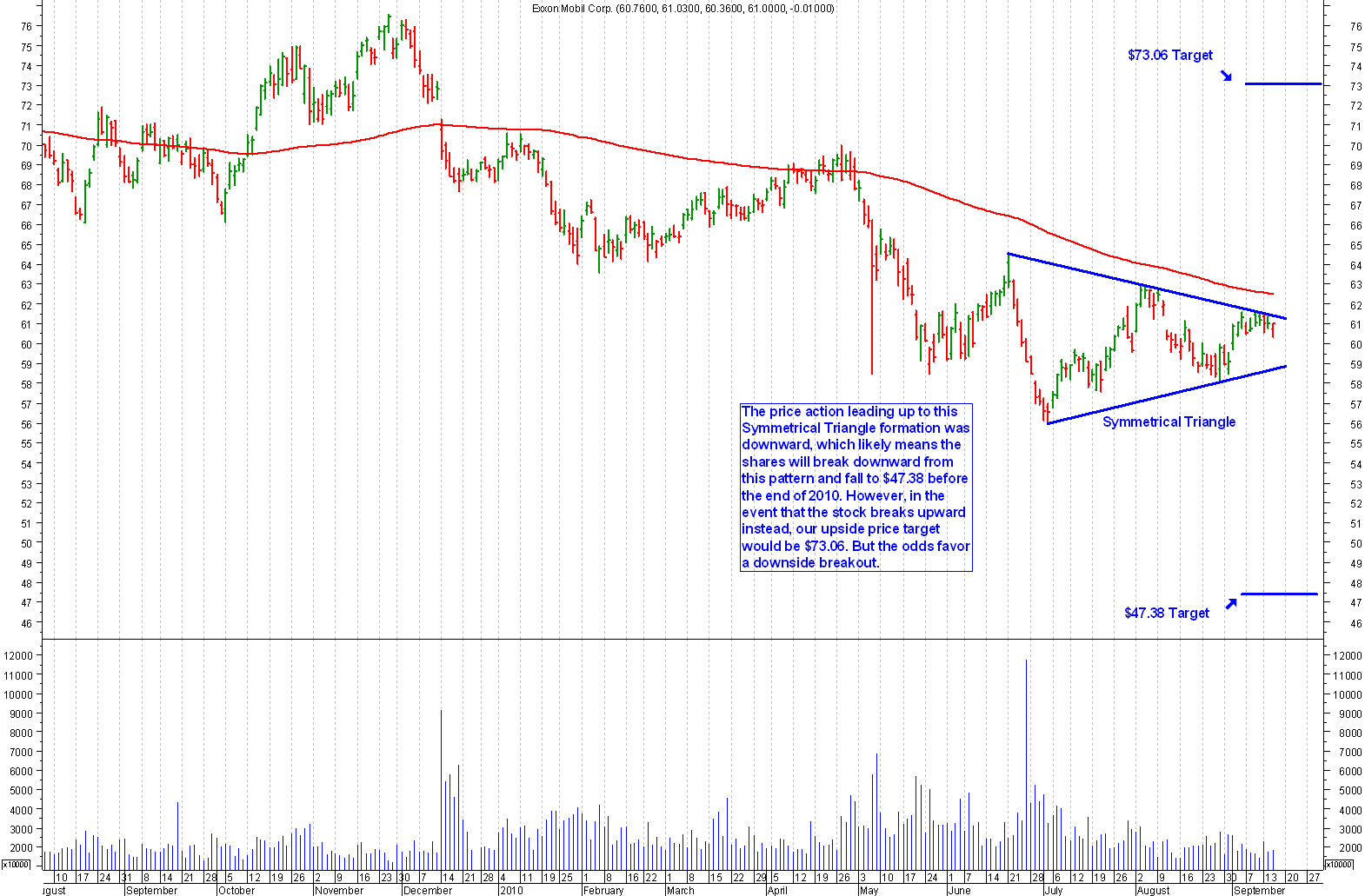

Comments: Since

peaking just north of $96 on May 21, 2008, Exxon Mobil's shares

have lost more than one-third of their value and now rest near $61.00.

And despite how bad this sounds, we strongly believe the shares

will continue drilling lower over the next few months. Why? Since

bottoming on July 2nd, the price action of XOM has traced out what

can only be described as a Symmetrical Triangle (Coil) Formation.

Since the shares typically breakout in the same direction as the

primary trend, which in this case has been down, we feel confident that

XOM will ultimately fall to new multi-year lows in the coming months.

If it was just this one company triggering a sell signal, we might start to wonder. But since our chart analysis also triggered a sell signal on Sunoco (ticker - SUN) within the past few days, the argument favoring additional downside is now much more convincing. The caveat: Symmetrical Triangles are the least predictable of all chart formations, since 16% of the time, the shares initially breakout in the wrong direction, before reversing course and heading the other way.

Now here's the best part: You can profit from a downside move between now and October option expiration for NO MONEY DOWN, or even get paid to initiate a bearish position (possibly not even including commission), by selling an out of the money call spread for a credit, then utilizing that credit to finance a shorter-term put option purchase.

Two possibilities you might consider are as follows: 1) Sell a January 2011 $62.50/$65.00 call spread for $0.95 and then use those proceeds to purchase an October $60 put for $0.94. You would receive a $0.01 credit to initiate this position, while the cost to you would be only the commission. 2) Or you could sell a January 2012 $62.50/$65.00 call spread for a $1.10 credit and use the proceeds to finance that same October 2010 $60 put for $0.94, netting you an immediate $0.16 per share gain before commission.

Note: Your maximum risk would be

$2.50/share times however many option contracts you trade and margin requirements

might also apply if you don't own the underlying security, which

in this case is Exxon Mobil stock.

|

[ Home Page ] |

[ Back ] |

[ Close Window ] |