ChartWatchCentral Premium Stock Picks

More Ether Please

by

Christina Nikolov

Founder/CEO,

ChartWatchCentral, Inc.

Date: April 20, 2011

Company: S&P 500 Depository Receipts

Ticker: SPY

Price: $133.10

Opinion: Bullish

Comments:

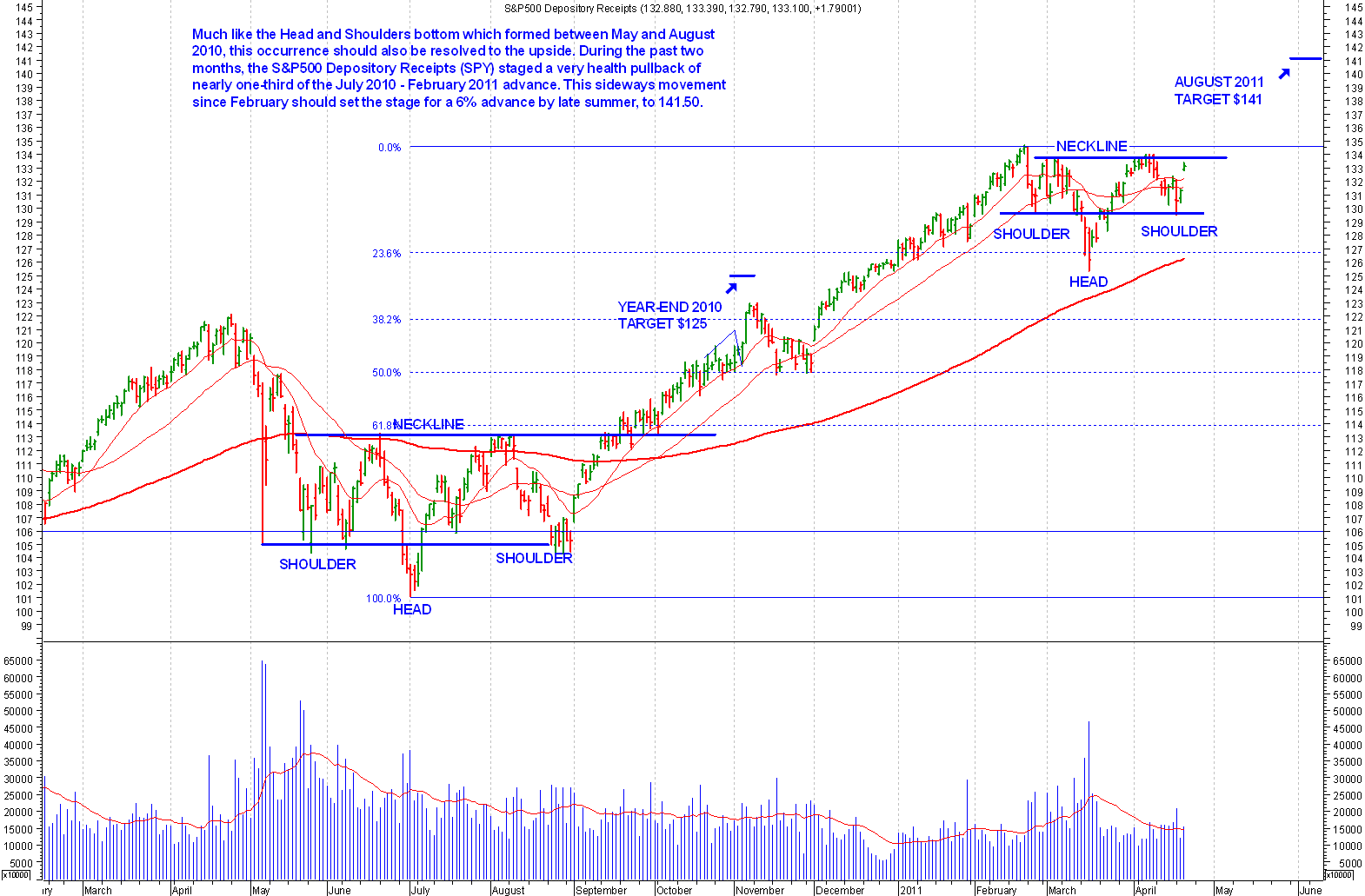

If you revisit the last time we wrote about the S&P500

Depository Receipts (SPY), the exhange traded fund was trading $20

lower, or nearly 15% below its current price level. Investor

sentiment was very negative back then and everyone was fleeing the

market like the world was coming to an end. The world didn't end

and our 2010

year-end prediction of $125 for SPY was right on the money.

The current picture is looking quite different, since sentiment is nowhere near where it was when we published our August 2010 commentary. Last August, 20% of individual investors were bullish, while more than half are bullish today. Despite the fact that strong market rallies rarely take place with bullishness so high (54%), the lack of disappointing economic news and decent corporate earnings, continues pushing the market higher.

Stock traders know this party will eventually end, because every party comes to a close sooner or later. But that isn't stopping them from taking advantage while they can, by pumping as much ether as they can into this market. After all, the bigger the boom, the bigger the bust. And these people are saavy enough to make money hand over fist on the way up, as well as the way down.

To profit from this opportunity, we suggest purchasing the August 130/135 call spread for $3.00, which breaks down to going long the August 130 call at $6.90 and short the August 135 call at $3.90. This particular spread was chosen because the long strike price is a major support level (the site the upside reversals marking the pattern's left and right shoulder ), while the short strike price is at the February peak (just above the depicted formation's neckline). With that in mind, you should expect to see the short call depreciate faster than the long call, resulting in an overall appreciation of the spreads value.

The best part is that SPY doesn't have to catapult itself to our upside target of $141 to make money, because your maximum gain of $2.00 per option ($200 per contract) will be realized as long as SPY is north of $135 on August 19th. SImply put, the market doesn't have to make much headway over the next few months, since SPY is currently trading just below $135.

Where else can you realize a 66% gain (before commission), while the item you are betting on goes pretty much nowhere?

|

[ Home Page ] |

[ Back ] |

[ Close Window ] |